Both ETFs rallied in the fourth quarter of 2023. So far this year, global equities have continued to rally, but global bonds have stalled.

What’s behind this? Some of the answer lies in US technology stocks. We’ve seen continued optimism in that space coming into 2024. That’s not been reflected across all equity markets. As an example, the chart below shows the performance of US and UK equities over the past twelve months. The steady outperformance of US equities since last May has continued into 2024.

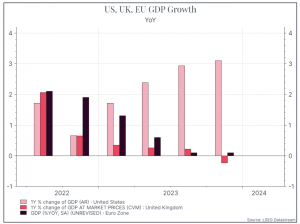

On the fixed income side, there was a lot of optimism towards the end of 2023 about how quickly policy rates would come down this year. That helped push down the yields on longer-dated bonds. But so far in 2024, we’ve seen inflation rates that have come in a bit higher than many analysts had expected – even if they generally continue to drift lower. At the same time, Central Bankers have moved to dampen down expectations of imminent and sharp rate cuts. We think Central Bankers would rather keep rates higher for longer and risk slower growth than cut early and risk inflation re-accelerating. That could be particularly true in the US where, as the chart below shows, economic growth has held up surprisingly well in the face of higher rates.

The divergence of bonds and equities so far this year raises some other interesting questions. Usually, the rule of thumb is that bonds and equities should move in opposite directions, but that isn’t always the case, and it wasn’t in, for instance, 2022 and 2023. For multi-asset portfolios having bonds and equities move in different directions is probably a positive – it allows for better portfolio diversification – something that proved challenging in 2022.

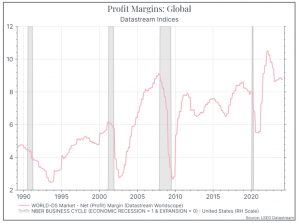

Why could it be happening now? One possibility is that equity investors are convinced that economic activity will remain resilient. Perhaps they’ve concluded that companies can earn healthy profits even with higher interest rates. As the chart below shows, corporate margins have so far held up pretty well.

In that case, how quickly interest rates come down – which was a focus of attention some months ago – might matter less for equities in the coming quarters.